Phuture DeFi Index

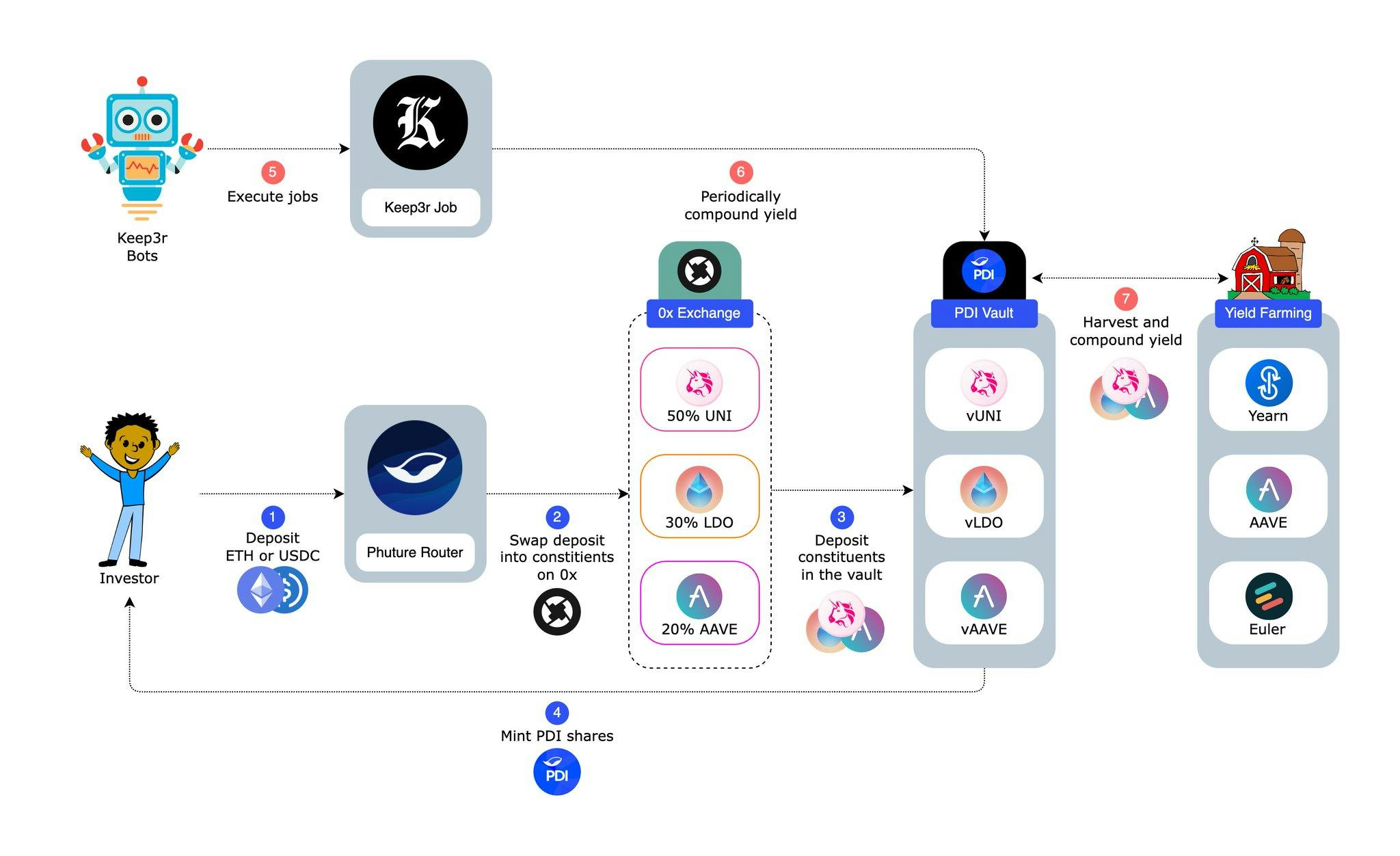

The Phuture DeFi Index (PDI) offers exposure to the top crypto assets by market capitalisation in the decentralised finance sector, known as DeFi. It is the only DeFi index to generate yield from the underlying tokens, utilising Yearn. The assets in this index are part of the Ethereum ecosystem.

Categories:

DeFi

Updated:

2023-04-03

Tags:

Yield Bearing

Ticker:

PDI

Token Strength.

Token Utility:

$PDI Balanced Exposure: PDI offers well-diversified exposure to the DeFi sector. Yield Potential: PDI captures additional returns from yield-generating DeFi protocols. Monthly Rebalancing: PDI follows a strict methodology and rebalances monthly to stay aligned with the DeFi market. Transparency and Security: Each PDI token is backed 1-1 with the underlying assets, ensuring transparency and security. Flexibility and Liquidity: PDI tokens can be redeemed for USD/ETH or the underlying assets at any time, providing flexibility and liquidity.

Demand Driver:

Demand of PDI won’t lead to price change. The price change comes from the constituent assets and demand for DeFi

Value Creation:

By following the PDI methodology and providing exposure to the top DeFi applications. PDI rebalances monthly and enables asset yield. Holders of PDI will always own the top-tier DeFi assets and have exposure to the DeFi ecosystem.

Value Capture:

Value accrual to token: $DPI captures value through its token by allowing holders to benefit from price appreciation as a result of managing, rebalancing, and generating yield from top-tier DeFi projects. The token's value is tied to the success of the underlying DeFi projects in the index. Value accrual to protocol: Phuture Defi Index captures value through its protocol treasury by earning fees from managing and rebalancing the index, which can be used to fund future development and growth of the platform.

Business Model:

The business model for Phuture Defi Index: Revenue comes from: entry fees (0.2%), exit fees (0.5%), and management fees (1%) Revenue is denominated in: DPI Revenue goes to: Protocol development, operational expenses, and governance, with percentages not specified.

Loading

Protocol Analysis.

| Problems & Solutions | Problem: Choosing individual tokens to invest in the DeFi sector can be time-consuming and risky. Generating yield from these tokens can also be complicated. Solution: The Phuture DeFi Index (PDI) simplifies the investment process by offering exposure to top DeFi assets through a single investment. PDI utilizes Yearn to generate yield from underlying tokens, providing investors with a diversified and efficient way to invest in DeFi. |

|---|---|

| Predecessors | DeFi Top 5 Index (DEFI5) - Offers exposure to the top five DeFi tokens by market capitalisation, rebalanced monthly. Metaverse Index (MVI) - Provides exposure to the top NFT and gaming tokens in the metaverse space. |

Investment Take

... coming soon

Tokenomics Timeline.

Loading

Loading

Loading