Tokemak Protocol

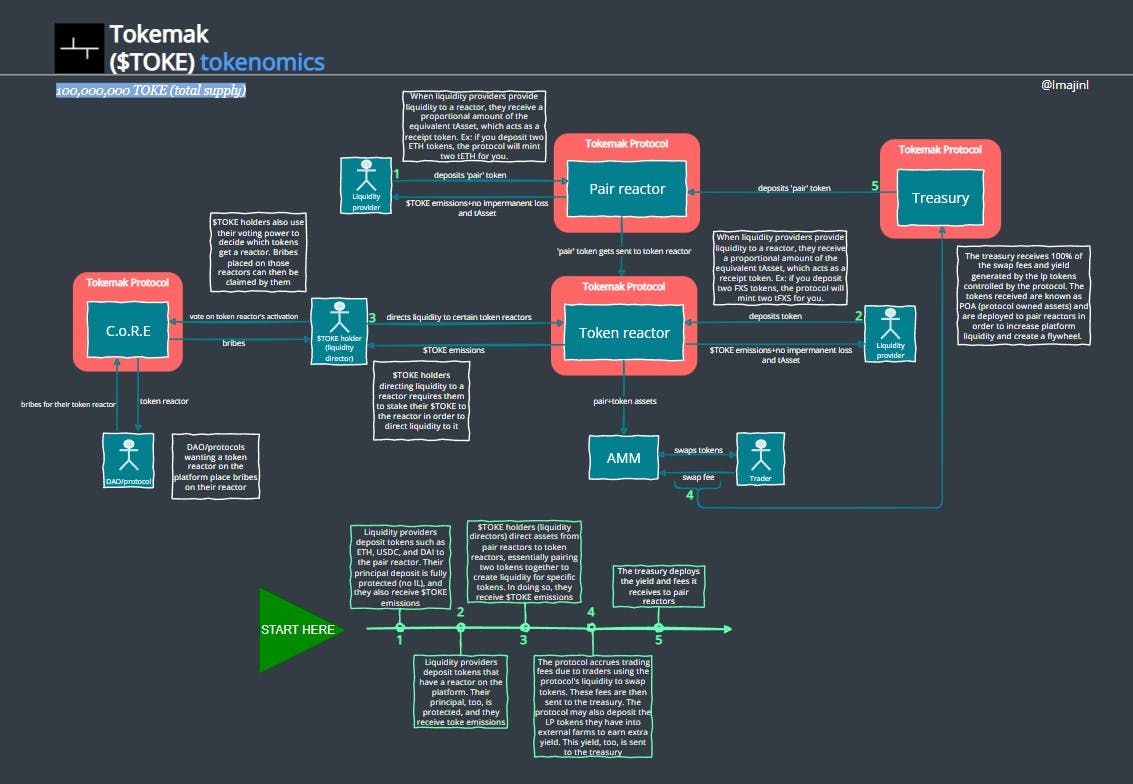

Through a seamless decentralized market-making protocol, Tokemak aspires to generate long-term liquidity and capital-efficient markets throughout DeFi. It also offers solutions to liquidity providers who do not want to be victims of impermanent loss.

Categories:

DeFi

Updated:

2023-04-03

Tags:

Liquidity Management

Ticker:

TOKE

Token Strength.

Token Utility:

$TOKE Powering the Tokemak protocol: $TOKE token directs available liquidity on the platform, making it an essential element of the protocol. Value accrual: $TOKE token accrues value generated by the protocol, such as fees and rewards, providing an incentive for users to hold it. Governance: $TOKE token holders can vote on which token reactors can launch on the protocol, providing a decentralized way to govern the platform.

Demand Driver:

Liquidity Direction: Traders and liquidity providers buy and hold $TOKE to direct and secure liquidity in a sustainable way on the Tokemak protocol, driving demand for the token. Liquidity Volume: Increased liquidity on the platform drives demand for $TOKE as more liquidity can be directed, increasing the capital efficiency of the protocol.

Value Creation:

The Tokemak protocol creates value for a myriad of parties. For protocols/DAOs wanting to secure liquidity, it allows them to do so sustainably and capital-efficiently and earn a yield on their treasury assets; for liquidity providers, it allows them to provide single-sided liquidity, i.e., no impermanent loss; and for $TOKE holders through governance (over which token reactor can set up shop).

Value Capture:

The Tokemak protocol captures value by taking 100% of the trading fees generated by deployed liquidity. Apart from that, the protocol also captures value by generating a yield on the assets held in the treasury.

Business Model:

The business model for Tokemak Protocol: Revenue comes from: Trading fees generated by liquidity pairs Revenue is denominated in: Whatever protocol owned liquidity (PoL) assets are being used to generate fees Revenue goes to: Protocol treasury, which earns a yield on underlying assets, and is used to provide liquidity to the platform when sufficiently large. Protocol takes 100% of trading fees.

Loading

Protocol Analysis.

| Problems & Solutions | Problem: Mercenary liquidity in DeFi causes impermanent loss for liquidity providers who are unwilling to take risks. This limits long-term liquidity and capital-efficient markets. Solution: Tokemak offers a decentralized market-making protocol to generate long-term liquidity and efficient capital markets. It addresses the issue of impermanent loss for liquidity providers, creating a safer and more sustainable environment for DeFi. |

|---|---|

| Predecessors | Curve Finance: A decentralized exchange focused on stablecoins and low-slippage trades, with an emphasis on providing liquidity for stablecoin pairs. Balancer: A protocol for creating and managing automated market makers that enables flexible liquidity pools and customizable trading fees. |

Investment Take

... coming soon

Tokenomics Timeline.

2021-03-18

Inception

The Tokemak protocol is announced

2021-07-28

LGE

The protocol and the Degenesis (LGE) are launched

2022-12-01

accTOKE

Locked $TOKE (accTOKE) is launched

Loading

Loading

Loading